Lumina Intelligence Q3 Food Strategy Forum – Key Insights for UK Foodservice

Alvi and I had the pleasure of attending the Lumina Intelligence Q3 Food Strategy Forum, where industry experts shared the latest economic, consumer and innovation trends shaping the UK foodservice landscape. With perspectives ranging from macroeconomic pressures to Gen Z drinking habits, late-night dining to the future of school catering, the session offered plenty of food for thought. Here are our key takeouts…

The Road Ahead: Economic Trends, Government Policy & Strategic Growth

Maggie Davis, Senior Insights Manager, Lumina Intelligence

Maggie set the scene with an honest look at the challenging economic outlook. Inflation remains stubbornly above target (expected to sit at around 3.4% this year), while consumer confidence has dipped back into negative territory ahead of November’s Autumn Budget.

Hospitality operators face some strong head winds –

- Business rates reform could offer smaller operators some relief, but larger sites are likely to pay more.

- Stealth taxation through frozen tax thresholds will squeeze disposable income, limiting consumer spending power.

- Employment Rights Bill (from April 2026) will bring higher costs and less flexibility for operators on top of the hike in NI already in place.

But it wasn’t all doom and gloom. Maggie highlighted how brands are fighting back through diversification and lifestyle positioning.

- Greggs continues to reinvent itself with bold PR plays – from champagne bars to its new pub concept in Newcastle.

- Co-op has launched ‘on-the-go micro stores’, targeting high-footfall sites with compact, food-to-go led formats.

- Partnerships and collabs (like Burger King’s wagyu burger with Gordon Ramsay, or Tortilla’s boxing gym tie-in) show how operators are leaning into cultural relevance and brand identity to stay front of mind.

Consumers: How are they Behaving and Feeling

Flora Zwolinski, Insight Lead, Lumina Intelligence

Flora’s deep dive into consumer behaviour painted a nuanced picture:

- Affluent 25–34-year-olds in London are driving market growth, especially through after-work drinks and socialising occasions. Meanwhile, younger Gen Zs (18-24s) are struggling to participate due to rising unemployment.

- Pubs and bars have experienced a resurgence, boosted by both hot weather and a surprising uptick in alcohol consumption, reversing the narrative that Gen Z doesn’t drink.

- Value, quality and health remain the three purchase drivers. Consumers define value not as ‘cheapness’, but as ‘great taste at a fair price’. Quality is often judged by ingredients and taste over portion size, while health is increasingly tied to low sugar, high fibre and reduced ultra-processed foods.

One striking stat: 51% of consumers now actively avoid some or all ultra-processed foods, creating opportunities for operators to innovate with minimally processed, fresh and seasonal menus.

Winning Concepts & Campaigns to Watch

Liv Warren, Insight Manager, Lumina Intelligence

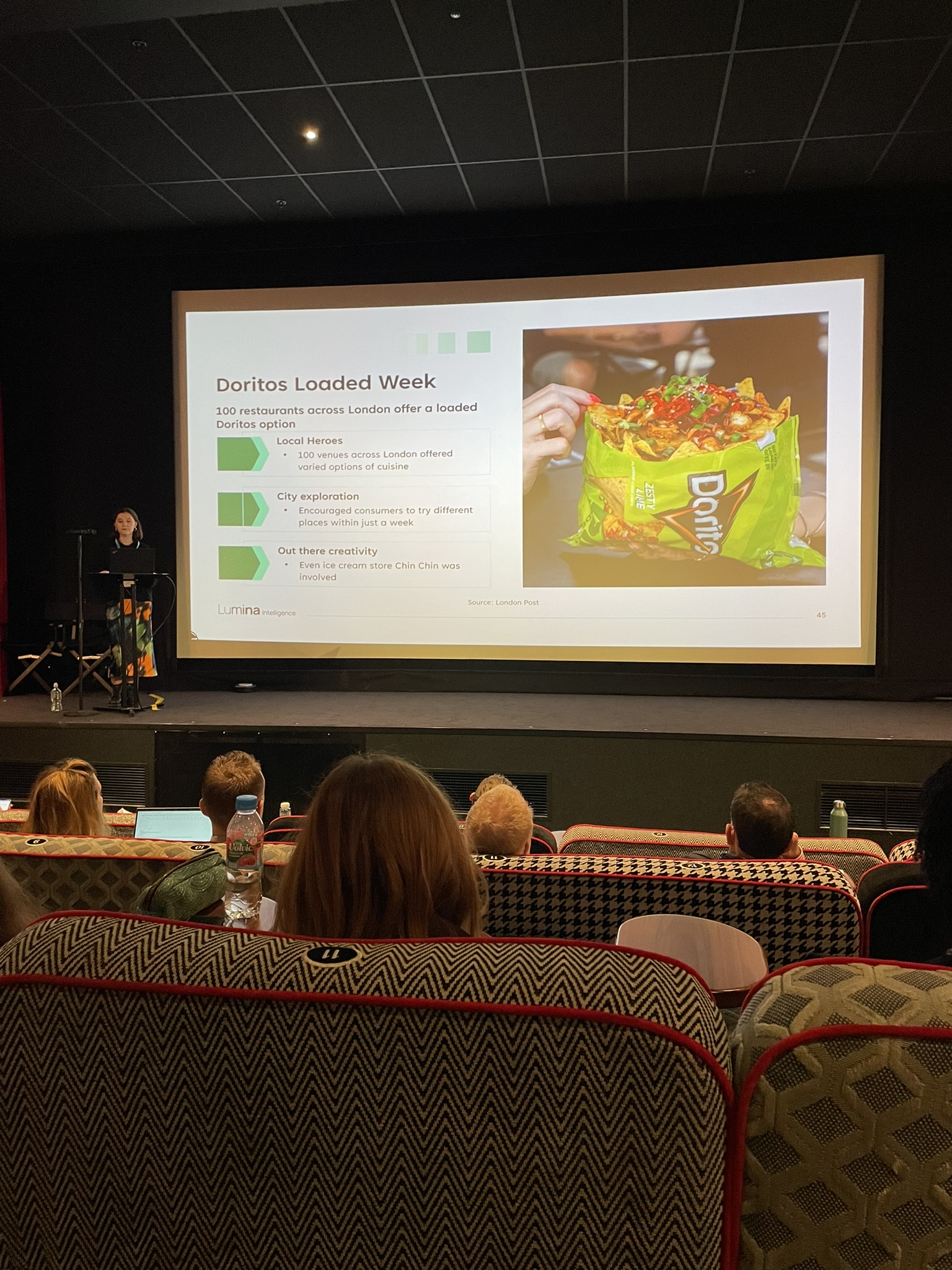

Liv spotlighted some of the most exciting campaigns and trends of the past quarter:

- Doritos Loaded Week – 100+ London restaurants collaborated on ‘walking tacos’, showing how discovery and co-creation can drive buzz.

- Sprite’s ‘Hurts Real Good’ campaign – cleverly pairing the soft drink with spicy foods, showing potential for soft drink + food pairing moments, usually reserved for alcohol.

- Heineken’s Bar Dating App – launched abroad, but a great example of digital innovation helping consumers break-out of routine and discover new venues.

On the trends front:

- Late-night dining is back, with restaurants offering discounts or extended menus to capture night owls and non-drinkers.

- Chicken continues to soar, with US brands and now Domino’s entering the space with customisable ‘chicken dips’.

- AI-generated food inspiration on TikTok – consumers are increasingly excited by co-creation, mashups and playful product ideas. Operators could harness this by opening up flavour voting or limited drops to make customers feel part of the innovation process.

Leveraging AI in Product Development

Anthony Saison, Head of Category & Customer Marketing, Mademoiselle Desserts

Anthony offered a fascinating case study on how AI is speeding up new product development without replacing the human touch.

- Mademoiselle Desserts launched its first AI-assisted cake last year – a mascarpone & blackberry round cake – which has since delivered 145% sales growth year-on-year.

- AI helped with flavour trend spotting, consumer sentiment analysis and concept generation, though many ‘quirky’ (and unusable!) ideas also emerged (caramelised onion brownies, anyone?).

- The key takeaway? AI is best used for overcoming creative block and accelerating ideation, while skilled bakers and marketers still bring the craft, context and emotional intelligence.

Lifting the Lid on School Catering

John Want, CEO, HCL Catering

John gave an eye-opening look into the realities of school catering – with HCL alone supplying 60,000 fresh meals daily across 450 schools.

- The funding gap is stark: government support provides just £2.58 per meal in many regions, leaving caterers to deliver a hot two-course meal on a shoestring budget.

- Allergy management is a huge challenge, with 450 bespoke menu variations in place to ensure every child can eat safely.

- High street trends are filtering into schools faster than ever – even 10- and 11-year-olds now expect grab-and-go options and protein-led dishes.

- Social media plays a surprising role, with teens keen to share ‘extreme spice challenges’ and foodie experiences, even in a school setting.

John’s big message: school food is not only about nourishment but about education, creating healthy habits early on, and reflecting broader food trends in age-appropriate ways.

Final Thoughts

From economic headwinds and consumer caution to bold campaigns and AI-driven innovation, the Q3 Forum reinforced just how fast-moving and adaptive the UK foodservice industry continues to be.

Three big themes stood out:

- Value redefined – it’s not about being the cheapest, but quality and fairness.

- Discovery matters – whether late-night dining, spicy pairings or TikTok food mashups, consumers crave novelty and participation.

- Responsibility in foodservice – from school meals to reduced ultra-processing, operators are under pressure to balance indulgence with wellbeing.

Plenty for us to take onboard as we help brands navigate this ever-changing landscape.

If you enjoyed reading this blog why not sign up to our newsletter & Trend Watch, to find out all the latest food and drink news, trends and what we’ve ‘bean’ up to.

- Feel Good Food: Exploring the Future of Eating Out on Lumina’s Q3 Food Study Tour - 8th October 2025

- Lumina Intelligence Q3 Food Strategy Forum – Key Insights for UK Foodservice - 8th October 2025

- Lumina Intelligence Q4 Food Strategy Forum - 12th December 2024